While the Golden Visa Program initially gained traction through real estate investments, the landscape has evolved, introducing diverse investment routes. Among these, the Golden Visa Investment Fund option has emerged as the most profitable option since the recent housing bill law changes passed in October 2023. Unlike the traditional real estate route, which requires investors to purchase property and have it managed etc, the Investment Fund option allows investors to invest in multiple qualified Portuguese investment funds amounting in total to 500,000 euros. This route has garnered attention for several reasons:

The rise of Portugal Golden Visa funds is not just a testament to its inherent benefits but also a reflection of global investors’ evolving needs and preferences. As the Golden Visa Program continues to adapt to these changing dynamics, the Investment Fund option stands as a testament to Portugal’s commitment to offering diverse and lucrative opportunities for those looking to gain citizenship by investment in Portugal.

The information presented on our website is solely for informational purposes and should not be used as investment advice. It is imperative that investors seek independent financial advice before making any investment decisions. This information is provided in line with our disclaimer.

An investment fund, in its simplest form, is a pool of capital collected from various investors, which is then invested in a diversified portfolio of assets. These assets can range from stocks and bonds to Agriculture, Green energy like Solar, Entertainment and Sport, and other alternative investments. The primary objective is to generate returns on the capital invested.

Scroll down to see an overview of some qualified Golden Visa Funds in Portugal.

Reason why getting the golden visa via funds is safe and how the returns work

The VC or Private Equity funds are a great way to invest and an excellent investment product to get your Golden Visa for several reasons:

Comparison with Other Golden Visa Investment Routes

While real estate has been the traditional route for Golden Visa applicants and offered benefits such as a real estate rental income in the form of residential tenants or commercial companies, the Portugal Golden Visa investment fund option offers a distinct set of advantages and considerations:

Benefits Over Traditional Routes

The Portugal Golden Visa investment fund option is not just about diversification; it’s also about tapping into sectors of the Portuguese economy that have significant growth potential. By investing in a venture capital fund or private equity fund, investors are indirectly supporting startups, tech companies, green initiatives and other ventures that might be the next big success story.

Portuguese investment funds provide a modern, flexible and potentially lucrative route for Golden Visa applicants. While it may not offer the tangible asset feel of real estate, many of the leading funds own valuable assets and have valuable contracts on these that produce income and growth. Another benefit is diversification, professional management and alignment with Portugal’s economic goals make it a compelling choice for many investors.

Football Strategies Fund is a fund that aims to acquire three football clubs and develop them from a junior league to the premier league in the country. The strategy is designed to generate exceptional profits. A football club is not only a machine of affiliation but also the owner of players’ passes and contracts, managing their careers, and developing their image and talent. The fund has hired a team chosen by RedBull to build and develop its portfolio of football clubs in Latin America and Europe.

Finance Fund is a fund that is changing the landscape in Portugal. It aims to help Portuguese companies finance their renewable energy portfolio through solar- and wind-energy-efficient producing facilities. The fund has been making these investments for the past three years, and they have proved to be stable and very generous. The fund aims to distribute a yearly dividend of 8% pa and capitalize the remaining income. It is registered under the most advanced ESG policy to achieve green investment status.

Agribusiness Fund 2 is a fund that blends environmental sustainability with financial stability, offering an investment experience that stands apart. Unlike the turbulent real estate market, agriculture provides a sanctuary of stability. It’s insulated from the typical boom-and-bust cycles, ensuring a more predictable appreciation tied to the ever-growing demand for food. Investors can expect a 5% annual dividend and an additional 15% liquidation bonus.

Entertainment Fund is a fund that focuses on the entertainment business in Portugal. The entertainment business in Portugal has snowballed over the previous 15 years, and this fund aims to capitalize on this growth potential. The fund will invest in restaurants, bars, rooftops, and concessions. It will focus on licensing spaces for entertainment such as festivals, concerts, and theme parks, investing in the setup of shows, restaurants, and bars, and finally taking part in developing tech companies related to the entertainment business.

It’s essential to note that while the above list provides a general overview of the requirements, the exact documentation and processes can vary based on individual circumstances and any changes in the program’s regulations.

The timeline for acquiring the Golden Visa is contingent upon diverse factors, encompassing your decision-making pace, document compilation speed, the proficiency of your chosen law firm, and the prevailing application load at the Serviço de Estrangeiros e Fronteiras (SEF) office during your submission.

Real Estate Property*

Capital Transfer*

Investment Fund

Minimum Investment

€350,000

€500,000

€1.5 million

€500,000

Taxes

28% Portuguese income tax

0%

IMI Transfer Tax

4.58%

6.5%

0%

0%

Stamp Duty

0.8%

0.8%

0%

0%

Notary Cost

€1,000

€1,000

0%

0%

Exit Fees

5%+VAT

5%+VAT

0%

0%

Commission

5%+VAT

5%+VAT

0%

0%

Performance Fee

28%

28%

0%

20-35% of the profit**

Management Fees

25 – 35% for rentals

0.5%

1.5 – 2% annually***

Legal Fees****

varies

varies

varies

varies

Total

(approximate without Exit Fees, Management Fee, or Legal Fee taken into account)

€369,840

€537,500

€1.5 million

€500,000

The Portugal Golden Visa program has undergone several changes over the years, reflecting the evolving priorities of the Portuguese government and the dynamics of the global investment landscape. Let’s delve into the recent modifications in 2022 and 2023 that have significantly impacted the program.

In response to the booming real estate markets in Lisbon and Porto, and with an aim to distribute foreign investment more evenly across the country, the Portuguese government introduced new regulations for the Golden Visa program, effective from 1 January 2022:

These changes were primarily aimed at driving foreign investment into Portugal’s interior regions, thereby alleviating the pressure on metropolitan areas and promoting development in lesser-known parts of the country.

|  |  |

In 2023, further modifications were proposed to the Golden Visa program. On 19 July, the Portuguese parliament voted in favour of restructuring the program, indicating a significant shift in the types of investments that would qualify. The most notable change was the exclusion of real estate investments from the program’s eligible options in favour of Portugal private equity or venture capital funds.

However, this decision faced opposition, and on 21 August, the President vetoed the “Mais Habitação Bill,” sending it back to Parliament for reassessment, citing inefficiencies.

In October 2023 the Real Estate investment has now been ended meaning the profitable way of investing and securing Citizenship is via an investment fund.

The Golden Visa program continues to offer several opportunities for investors, but it’s crucial to stay updated with the latest changes and understand their implications. This ensures that potential investors can make informed decisions that align with both their personal objectives and the evolving landscape of the investment funds that qualify.

From our perspective, the investment in Property vs the investment in VC/PE Funds have very aspects in common.

Both investments have a real asset behind them. Most investors like to invest in Property for its security and durability. In fact an investment in Agribusiness or Solar Energy assets are very similar assets. In fact, they are safer, due to its capacity to reconvert in other projects.

Profitability. Both can generate a fixed income to the investor. But the funds allow for a most favourable tax structure and incentive. The tax footprint with a Fund is much smaller than with Property.

Growth. The investment in VC/PE allows the investor to take part in the growth of the projects where we will be invested. On the Football strategy fund, we will invest in something unique: human ingenuity and strength!

|  |  |

In a nutshell, most investors have been accustomed to the investment in funds. Allows for a wider diversity of projects and assets, reducing risks and costs.

Portugal, a gem on the Iberian Peninsula, has long been a favoured destination for travellers, retirees and investors alike. But what makes it such an attractive option for those seeking the Golden Visa?

In essence, Portugal’s allure isn’t just about its scenic beauty or rich heritage. It’s a combination of tangible benefits, strategic advantages and the promise of a high-quality life. The overwhelming success of the Golden Visa program is a testament to Portugal’s appeal and its ability to offer value to global investors.

The Portugal Golden Visa fund option offers several financial benefits that make it an attractive choice for Golden Visa applicants:

Investment funds in Portugal are subject to stringent regulations, ensuring transparency, security and accountability:

One of the primary advantages of investment funds is the diversification they offer:

The Investment Fund route for the Portugal Golden Visa offers a combination of financial benefits, security and growth potential. While every investment carries inherent risks, the regulatory environment, professional management and diversification of these funds make them a compelling choice for many investors.

Anticipating the Evolution of the Golden Visa Program

The Portugal Golden Visa program has been a beacon for international investors since its inception. As with any dynamic program, it’s expected to evolve in response to global trends, economic shifts and policy changes. Here’s a look at potential future changes and trends in the Golden Visa program:

The future of the Golden Visa program is likely to be shaped by a combination of internal economic needs, global trends and the evolving landscape of investment migration. While the core appeal of the program is expected to remain, potential investors should stay informed and adaptable to make the most of the opportunities that lie ahead.

| Year | Real Estate (€500,000+ or €400,000+ properties) | Real Estate (€350,000 or €280,000 renovated properties) | Capital Transfer |

| 2019 | 1,200 (approx.) | 900 (approx.) | 300 (approx.) |

| 2020 | 1,100 (approx.) | 950 (approx.) | 320 (approx.) |

| 2021 | 1,050 (approx.) | 920 (approx.) | 310 (approx.) |

| 2022 | 1,000 (approx.) | 890 (approx.) | 300 (approx.) |

| 2023 | 950 (approx.) | 860 (approx.) | 290 (approx.) |

Interviews provide a unique perspective, offering insights from those who have firsthand experience or deep knowledge about a subject. For the Portugal Golden Visa program and the Investment Fund option, we’ve curated insights from financial experts, legal professionals and successful Golden Visa recipients.

Q: What makes the Investment Fund option stand out compared to other Golden Visa investment routes?

Maria: “The Investment Fund option offers a diversified approach. Instead of putting all your money into a single property, you’re investing in a portfolio of assets. This diversification can mitigate risks and potentially offer more stable returns.”

Q: How do you see the future of the Investment Fund market in Portugal?

Maria: “It’s promising. With the increasing global interest in Portugal and the success of the Golden Visa program, I anticipate more sophisticated and varied investment funds emerging, catering to different investor profiles.”

Q: What are the common challenges applicants face when opting for the Investment Fund route?

João: “Understanding the nuances of the fund, such as its structure, fees, and exit strategy, can be challenging. It’s crucial to have clear communication with the fund managers and to consult with legal professionals to ensure a smooth application process.”

Q: Any advice for potential Golden Visa applicants?

João: “Always do your due diligence. Understand the investment, the terms and the implications. And always consult with an immigration lawyer to ensure you’re meeting all the requirements.”

Q: Why did you choose the Investment Fund option for your Golden Visa?

Li Wei: “I was looking for a hands-off investment. I didn’t want the responsibilities of property management. The Investment Fund option seemed like a perfect fit, offering potential growth without the day-to-day involvement.”

Q: How has your experience been so far?

Li Wei: “It’s been positive. The application process was straightforward and I’ve seen steady growth in my investment. I’m optimistic about the future and am considering further investments in Portugal.”

These interviews offer a glimpse into the world of the Portugal Golden Visa program through the lens of experts and those who’ve walked the path. Their insights and experiences can be invaluable for potential investors, helping them make informed decisions.

Hearing from those who have successfully navigated the Portugal Golden Visa program can provide invaluable insights and inspiration. In this section, we share testimonials from satisfied investors and delve into specific case studies that highlight the journey from investment to obtaining the Golden Visa.

“I always dreamt of living in Europe and the Portugal Golden Visa program made it a reality. Opting for the Investment Fund route was one of the best decisions I’ve made. Not only did I secure my residency, but I also saw a decent return on my investment. The process was smooth and the professionals I worked with were top-notch.”

“We wanted a secure future for our children and Portugal seemed like the perfect place. The Golden Visa program was our gateway. We invested in an Investment Fund and within a few years, we saw our investment grow. The best part? Our children now have the option to study, work and live anywhere in the EU.”

“Portugal felt like home from the moment I visited. The Golden Visa program was a natural choice for me. The Investment Fund option was hassle-free and the returns were beyond my expectations. I’m now considering buying a property here too!”

Background: Sarah, a tech entrepreneur from San Francisco, wanted to diversify her investment portfolio and was keen on gaining European residency.

Investment Choice: After thorough research, she chose the Investment Fund route for her Golden Visa application.

Journey: Sarah worked closely with a financial advisor and legal professional in Portugal. She invested in a tech-focused fund that aligned with her background. Within three years, the fund saw significant growth, thanks to the booming tech scene in Lisbon.

Outcome: Sarah secured her Golden Visa, saw a 15% growth in her investment, and is now actively involved in the Lisbon tech community, mentoring startups.

Background: Ahmed and Layla, a retired couple from Dubai, wanted a peaceful place to spend their retirement years. They were also keen on securing EU residency for their children.

Investment Choice: They opted for a real estate investment initially but later diversified by investing in an Investment Fund.

Journey: The couple purchased a beautiful villa in the Algarve and also invested in a tourism-focused fund. The fund invested in boutique hotels and eco-tourism projects across Portugal.

Outcome: Their real estate appreciated in value and their investment fund saw steady growth. Their children now study in Europe and have the flexibility to work across the EU.

These testimonials and case studies offer a glimpse into the varied experiences of investors in the Portugal Golden Visa program. Their stories underscore the program’s potential benefits and the importance of making informed decisions.

Navigating the Investment Fund Route: Aligning with Your Goals and Making Informed Decisions

The journey through the Portugal Golden Visa program, particularly the Investment Fund route, is one filled with opportunities, potential returns and the promise of European residency. However, as with any investment decision, it’s essential to ensure that the chosen path aligns with your personal and financial goals.

Assessing the Portugal Investment Fund Route

ThePortuguese investment funds for Golden Visa offer a diversified approach to obtaining the Golden Visa. It provides a hands-off investment experience, managed by professionals and the potential for growth. However, it’s crucial to:

The Importance of Independent Advisory

Making an informed decision is paramount. The Golden Visa program, while lucrative, comes with its complexities and nuances. Hence, it’s vital to:

The Portugal Golden Visa investment fund route for the Portugal Golden Visa program is a promising avenue for many. However, it’s essential to ensure it aligns with your goals and to arm yourself with knowledge and expert advice. By doing so, you can navigate the program confidently, making the most of the opportunities it presents.

Your thoughts, experiences and insights matter to us. As we delve deep into the Portugal Golden Visa program and the Investment Fund option, we invite you to be an active participant in this journey. Here’s how you can engage:

Share, Ask and Connect:

Newsletter Signup – Stay Informed:

We believe in the power of community and shared knowledge. By engaging with us, you not only enhance your understanding but also contribute to a richer, more informed reader community. Let’s embark on this journey together!

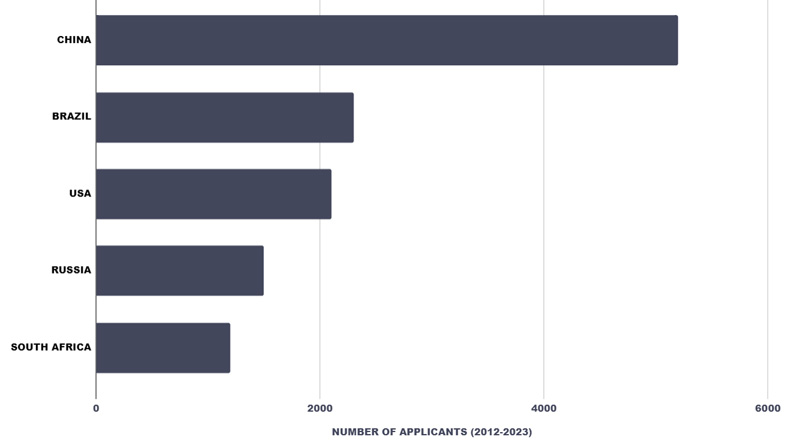

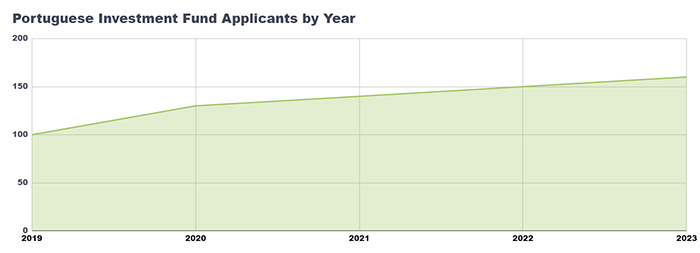

Between 2012 and 2023, the Portuguese government allowed individuals to obtain the golden visa by investing in real estate. However, in October 2023, the government introduced new legislation that significantly altered the investment regulations. Under the new law, investment in real estate is no longer permitted, and investment is limited to direct company investment aimed at creating jobs or through Private Equity or Venture Capital Funds. Moreover, these funds must be registered in compliance with Portuguese legislation and have a minimum maturity of five years. In addition, 60% of the fund must be invested in companies that have a head office in Portugal.

propertylisbon.com, an introducer to regulated Fund Managers, does not provide investment advice but can connect interested parties with reputable fund managers. However, it is crucial to note that the investment information provided by propertylisbon.com owned by Property People London & Lisbon LTD is subject to our disclaimer. This disclaimer outlines the terms and conditions under which we operate and is critical for individuals who are interested in investing in Portugal.

Already have an account? Log In

Enter your email address and we'll send you a link you can use to pick a new password.

Chat with WhatsApp

Can't find what you are looking for?

Never miss a thing!

Can't find what you are looking for?