Whatever your Portugal or Lisbon real estate dreams, our portfolio has a wide range of properties, and our team of experts are primed and ready to help find the right one for you.

For instance, if you’re looking for a roomy property with lush grounds, a pool and plenty of living and entertainment space for yourself and an extended circle of family and friends, a well-appointed Portugal villa is a prime haven of privacy and exclusivity.

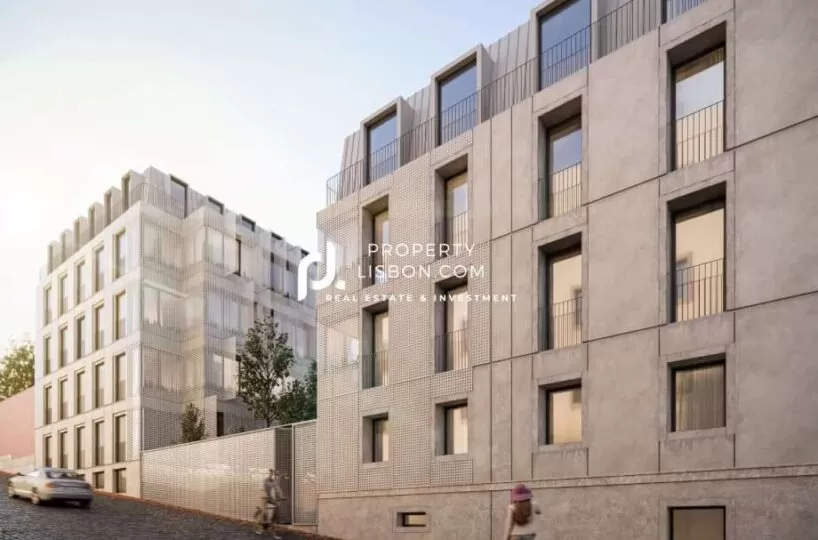

Alternatively, buying a Condo in Portugal Lisbon affords the advantages of a discrete entrance to your own plush pad in this stunning city. And depending on your desired neighborhood, you can find standalone, duplex, or triplex properties.

Meanwhile if you’re looking to capitalize on Lisbon’s tourist trade, tap into businesses that serve locals and incomers alike, and profit from the Golden Visa program, a commercial property in Lisbon or a touristic licensed condo could be right up your street and represent a highly profitable way to expand your portfolio.

Many of the above Portugal properties are available as new builds or in authentic traditional styles.

Last but not least, buying a plot of land in or around Lisbon (or another prime area in Portugal) allows you to build your property dreams up from the ground, to create a solid foundation for your future with a completely customized project tailored to your needs.